Terra’s Anchor protocol hits $4 billion in TVL 6 months after launch

Terra’s Anchor protocol hits $4 billion in TVL 6 months after launch Terra’s Anchor protocol hits $4 billion in TVL 6 months after launch

The only two lending protocols with higher TVLs than Anchor are Aave and Compound with $14 billion and $11 billion in TVL, respectively.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Just six months after its launch, Terra‘s Anchor protocol surpassed $4 billion in total value locked (TVL). The Terra-native savings protocol offers users 18-20% yields on stablecoins and has quickly positioned itself at the forefront of DeFi.

According to a recent report, the protocol is set to continue its growth, albeit at a slower and more sustainable rate, and continue its path towards self-sustainability.

Anchor’s attractive stablecoin yields make it the third most popular DeFi protocol

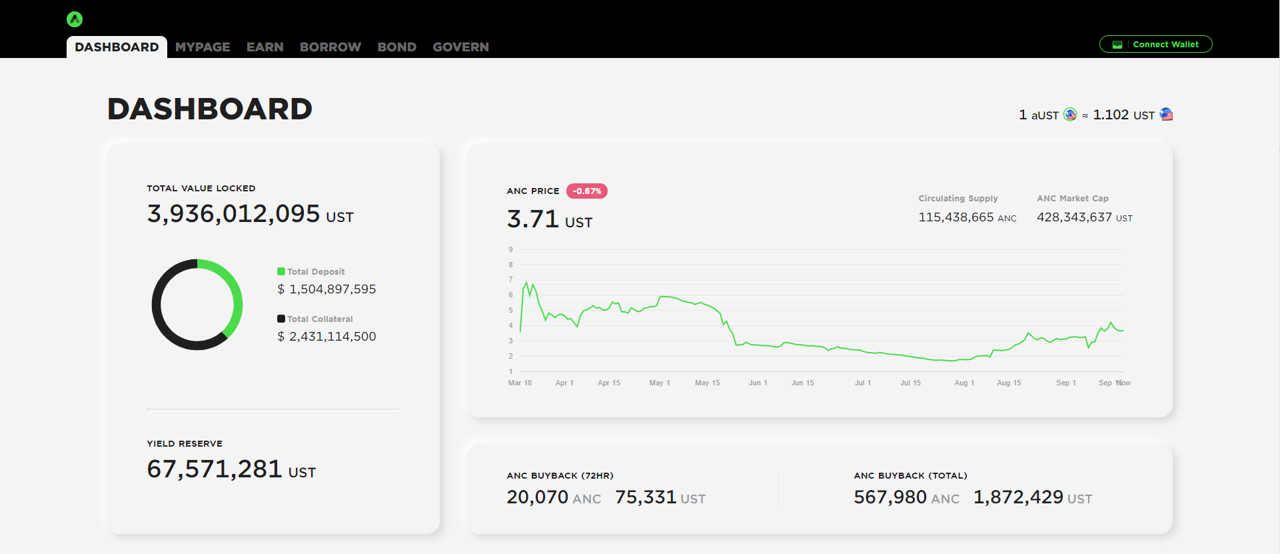

Officially launched on March 18th on the ambitious Terra blockchain, Anchor protocol has quickly positioned itself as a leading yield farming protocol in the world of DeFi. Just six months after going live, the protocol boasted over $4 billion in total value locked (TVL).

And while the number of funds locked in Anchor dropped slightly below $4 billion in the past week, the protocol still continues to grow in almost every metric.

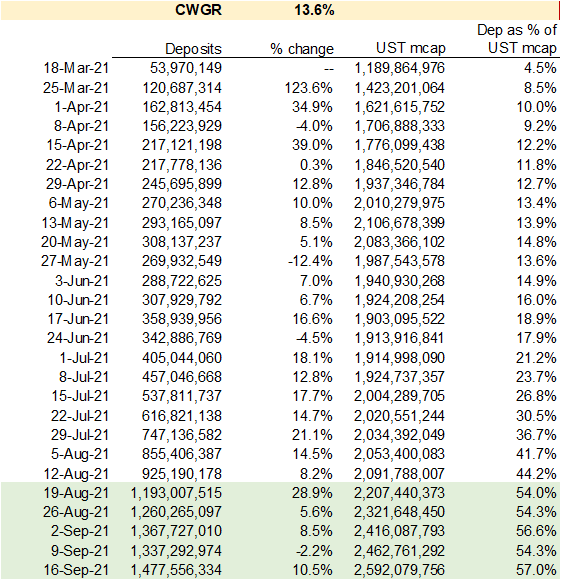

According to a recent report, Anchor’s deposits grew alongside UST‘s market cap. The Terra-native stablecoin has proved to be hugely popular among Terra’s growing user base and many have made depositing on Anchor their first interaction a protocol. The report noted that there was an almost perfect correlation between the amount of UST bought and the amount of UST deposited on Anchor.

Data from Anchor showed that in March, Anchor’s deposits represented just 10% of UST’s market cap. As the protocol gained more traction, its deposits grew to represent 56% of UST’s market cap.

Diving deeper showed that Anchor’s deposits have historically grown by a compound weekly growth rate (CWGR) of 13.6%.

However, the report noted that it was highly unlikely Anchor would continue growing at this pace until the end of the year. The target for UST’s market cap by the end of 2021 is $10 billion and it would be highly unlikely that the entire supply of UST would end up locked in Anchor.

As Terra grows, users will begin searching for more means of utilizing UST, LUNA, and other Terra tokens. This doesn’t mean that Anchor will lose its value within the Terra ecosystem, as there could be other liquid staking derivatives added to its offer.